The market continues to be too oversold to short.

For the last five weeks, $DXY, the dollar index, has moved sideways in a narrow range. If it comes down, that may provide some bullish impetus to the market. But that is not the case yet.

All the market ETFs fell. $IWM broke below weekly Watermark support. There is no support nearby. It is at Jump/Thhrust Low - an extremely oversold condition.

$DIA broke below weekly Memory trendline support. There is no other support nearby. It is nearing Jump/Thrust Low.

$QQQ was also down for the week. But it has white Direction line support in daily nearby.

$SPY also fell for the week. It has weekly and daily Memory support some distance away.

Overall the ETFs are bearish and all, especially $IWM, are oversold. A bounce from here will give many lucrative buying opportunities. I will wait for a proper buy signal. Oversold markets can get more oversold. And often does so.

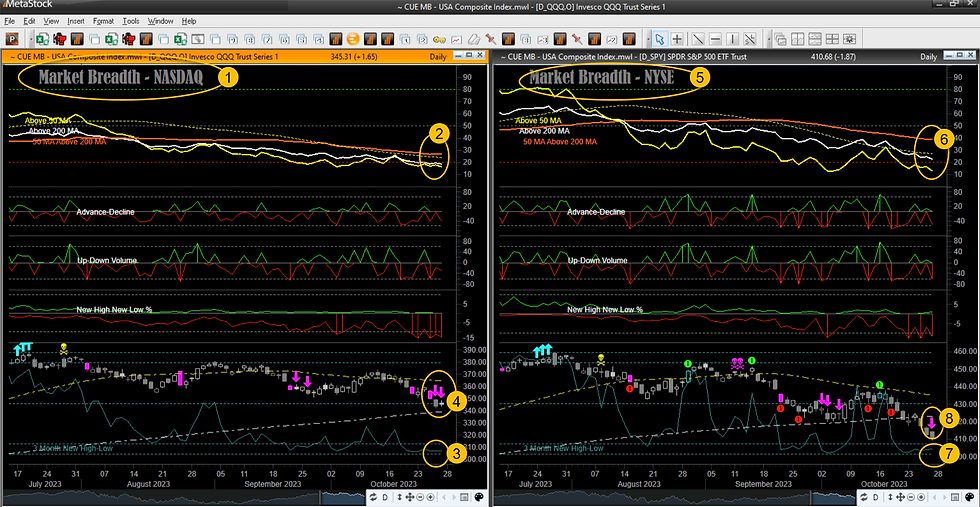

In terms of Interla Breadth, whether you look at Total View, Composites, or Major Indexes, all are oversold both in terms of % of stocks above 50 DMA as well as 3-month New High-Low. Also, there are a series of Bingo (sell everything, even those of value) signals in multiple breadth charts. Once again a bounce from here may give lucrative buy setups. But I will wait for that.

CUE Sector-industry-stock breadth and Technical breadth are also bearish. No buy signal there either.

All across the board, the market is weak. It is oversold - too oversold to short. And not enough buy signals to buy. That is resulting me in me having no preferred trading direction. I am standing aside. And under such a situation I do not like to look at stocks. If the market tells me to stand aside, why look at stocks, I think to myself.

As always, I will keep watching the market with real-time CUE and when the buy signals come, I should be able to catch them in time. I wait for that.